International Student Loan Variable or Fixed Rate – which should I choose?

If youre looking for an international student loan to study in the USA, one of your first considerations is whether to get a fixed or variable rate student loan. But theres a lot of confusion about the difference between these two types of student loans, and what this means in terms of future payments and financial risk.

The good news is that Edupass has you covered – read on for everything you need to know!

Fixed vs. Variable Interest Rate Private Student Loans to Study in the U.S.

Fixed-rate loans are just what they say they arefixed, which means that your rate never goes up! A fixed interest rate, for example, will simply be quoted as 12% or 10.5%.

Variable interest rates, also known as floating or adjustable interest rates, change based on market fluctuations. They are determined by two components:

- The benchmark, that fluctuates with market conditions; and

- The spread, which is the additional amount you will be charged over and above the benchmark, expressed as a percent.

The standard benchmark for variable student loan rates used to be the LIBOR or, to give it its full name, the London Interbank Offered Rate. This has now been replaced to a greater extent, at least in the United States, with SOFR (the Secured Overnight Financing Rate).

A variable interest rate is quoted with the benchmark and the spread, e.g., SOFR + 8%. The loan agreement will also specify how often your rate will be adjusted (e.g., every month or every quarter, based on changes to the underlying benchmark rate).

So Which is Better: A Fixed Rate or Variable Rate Student Loan?

The short answer is that it depends on your tolerance for risk. The initial interest rate for variable rate student loans is typically lower than for fixed rates, but if and when market rates spike, the interest rates on these loans can surpass fixed interest rates.

There are three major advantages of a fixed-rate student loan over a variable rate loan:

- You know in advance exactly what your monthly payments will be, which is very helpful when budgeting your student loan payments and determining if you will be able to afford your loan payments after graduation.

- You know in advance the total amount you will pay over the life of the loan, which means you can more accurately estimate the return on investment for your degree.

- The lender bears all interest rate risk. If rates go up, its cost of capital goes up but your interest rate and loan payment stay the same!

That said, theres one major advantage for variable rate student loans: if market rates stay low, you may end up paying less for a variable rate loan than for a fixed rate loan.

Of course, if the benchmark goes up sufficiently high, youll end up paying significantly more. And if youre lucky and it goes down, youll pay even less than the introductory rate.

Market Trends Suggest Variable Rates Will Rise, But No One Can Say by How Much

No one can say with any certainty whether SOFR or other benchmark rates will rise. However, Kiplingers interest rate forecast stated that expectations of the future path of interest rates showed a gradually rising trend over the next two to three years. Historically, LIBOR rates have been very volatile, rising to nearly 11% in 1989.

How Fixed-Rate International Student Loans to Study in the USA Work: An Example

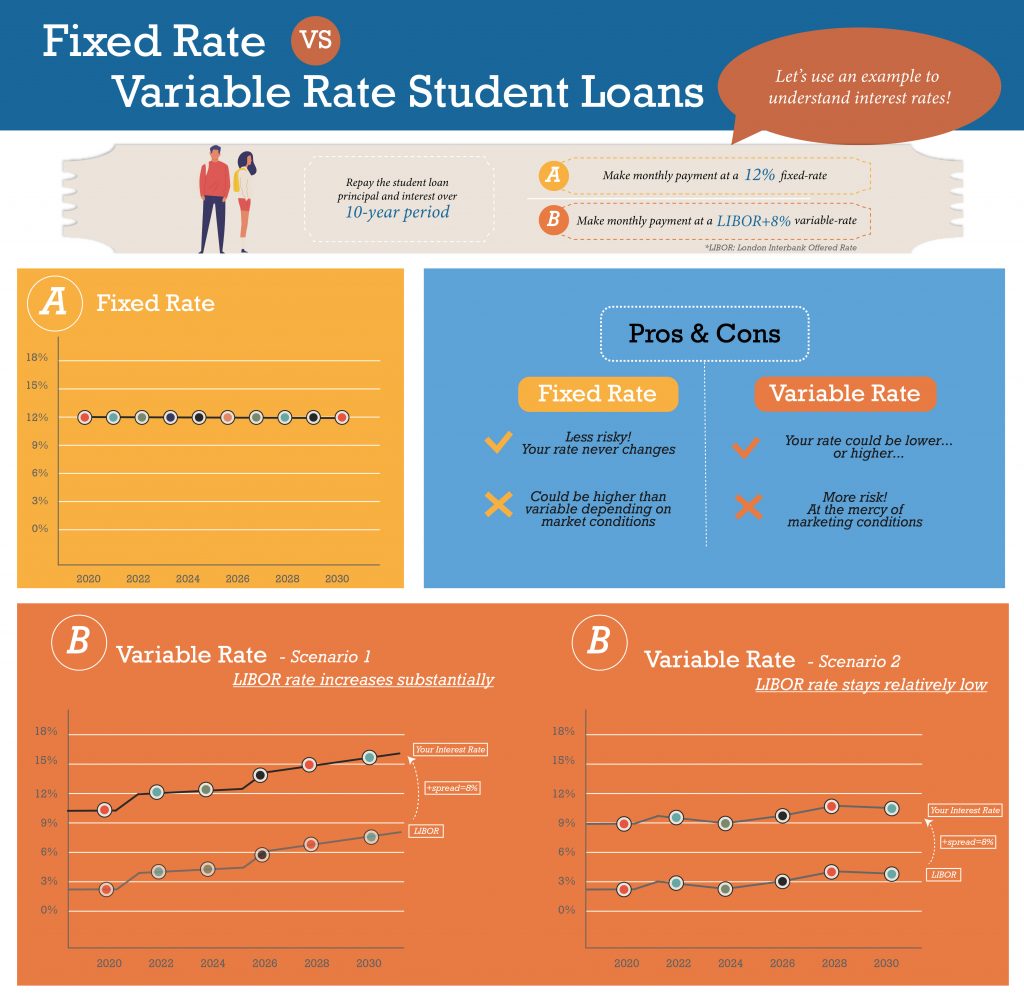

Lets say you borrow $30,000, and you repay the student loan principal and interest over a 10-year period, with payments to be made monthly at a 12% fixed interest rate.

Using a student loan repayment calculator or a simple Excel formula, you can calculate that your monthly payment will be $430.31 (assuming interest is calculated on a monthly, not daily, basis). You will pay this same amount every single month for ten years. The only thing that will change is the relative proportion of each payment that is for interest or principal. In the beginning of your loan, a higher percentage of the payment goes towards interest and, in later periods, more of this payment goes towards paying down the principal.

In the first month, for example, you still owe $30,000, so the interest payment would be $300. You calculate this by multiplying the amount owed by the quotient of the annual interest rate divided by the number of payment periods in a year. So, since payments are made monthly and there are 12 months in a year, the monthly interest paid in the first month is $30,000 x (.12/12) = $300. The difference between your $430.31 payment and the $300 interest charge is $130.31, so your principal is reduced by $130.31.

The next month, you calculate interest based on the new principal amount of $29,869.59. While the payment stays constant at $430.31, now only $298.70 is attributable to interest, so the amount of principal paid increases to $131.72.

Each month you pay more principal and less interest until your principal balance is zero!

Assuming that you make on-time payments, do not pay off the loan early, and do not receive any lender interest rate discounts, you will pay a total of $51,649.54 over the course of the loanand this will not change regardless of market conditions!

How Variable-Rate International Student Loans to Study in the USA Work: An Example

Lets take the same $30,000, 10-year student loan from the fixed-rate example but assume that its a variable rate loan with an interest rate of SOFR + 8%.

That means youll pay 10% interest initially (because 2% + 8%=10%). The lender calculates the monthly payment as if the rate will stay constant (even though it wont!), so the initial monthly payment will be $396.45 (assuming interest is calculated monthly, not daily). So for that first month, youll save about $34 over what you would have paid to borrow the same amount with a 12% fixed-rate loan (see fixed-rate example above).

If SOFR rises to 4%, however, your interest rate will rise to 12% (because 4% + 8% = 12%). Now youre paying the same interest rate as you would in the fixed-rate example above. The lender will then recalculate your monthly payment based on three factors: (a) the new interest rate of 12%, (b) the number of months you have left on your loan, and (c) the amount of principal you still owe.

If SOFR rises to 8%, your interest rate will rise to 16% (because 8% + 8% = 16%). Lets say this happens at the end of year 4, so you have 72 months remaining on your loan. Lets assume that you have $22,106.17 in principal outstanding. (This is the principal that would be outstanding if interest rates rose at a constant 1.5% per year over these four years and the rate was only adjusted at the beginning of each year.) Your new monthly payment would be $479.52, roughly $50 more than you would be paying per month under the fixed-rate scenario above.

On the flip side, lets say SOFR rates go down to 1% at the end of year 1, so you have 108 months remaining on your loan and $28,159.74 in principal outstanding. (This is the principal that would be outstanding after making 12 months of $396.45 payments with a 10% interest rate, as described at the beginning of this section.) Your new interest rate would be 9% and your monthly payment would then go down to $381.36…and stay there until rates rise again.

The Bottom Line on Fixed vs. Variable Rates

The bottom line is that only you know if youre willing to take the risk that your payments will suddenly jump in return for a lower introductory rate.

And remember, fixed vs. variable isnt the only factor driving a loans affordability. Other factors include:

- The length of the loan period The longer you have to pay back your loan, the lower individual payments will be but the more you will end up paying overall!

- Whether interest accrues while you are in school If you are not making interest payments while in school, the interest that accrues will be added to the principal amount so the principal amount will actually increase over and above what you originally borrowed! That means that monthly payments will be higher when the loan starts to amortize.

- Lender discounts Some lenders will offer you discounts in exchange for completing certain requirements. Edupass affiliate MPOWER Financing, for example, offers an interest rate discount on its fixed-rate loans for enrolling in autopay.

We wish you the best of luck with choosing the right loan product for you!

Learn about Student Loans for International Students.

Frequently Asked Questions

What is the difference between fixed and variable rate loans?

Fixed-rate loan means the rate of interest on your loan does not change over time. Variable-rate loan is where the rate of interest of your loan can change (based in “index”) over time

What is better variable or fixed interest rate?

Variable interest rates can start at a lower rate than a fixed interest rate, but depending on the circumstances of the market, the variable interest rate may increase over time and further increasing your monthly repayment as well.